There are several different tax forms that individuals and businesses may be required to use when filing their taxes.

The 1099 series of forms, such as the 1099-MISC, 1099-NEC, 1099-INT, and 1099-DIV, are used to report various types of income that are not salary or wages earned as an employee.

The W-2 form is used to report wages and other employee compensation.

The 1099-B form is used to report the sale of securities, such as stocks or bonds.

The 1099-C form is used to report cancelled debt, such as when a lender forgives a loan.

The 1099-R form is used to report distributions from a retirement account, such as an IRA or 401(k).

The 1042-S form is used to report certain types of income received by a foreign person or business.

It is important to use the correct form to

accurately report all income on a tax return.

Simple Pricing, No hidden fees.

| Quantity | E-File & Print | E-File Only |

| 1-25 | $30 | $27 |

| 26-75 | $27 | $24 |

| 76-150 | $25 | $22 |

| 151+ | $22 |

$20

|

Click each link below to enter the world of IRS forms

- Taxpayer beware, you are in for a scare

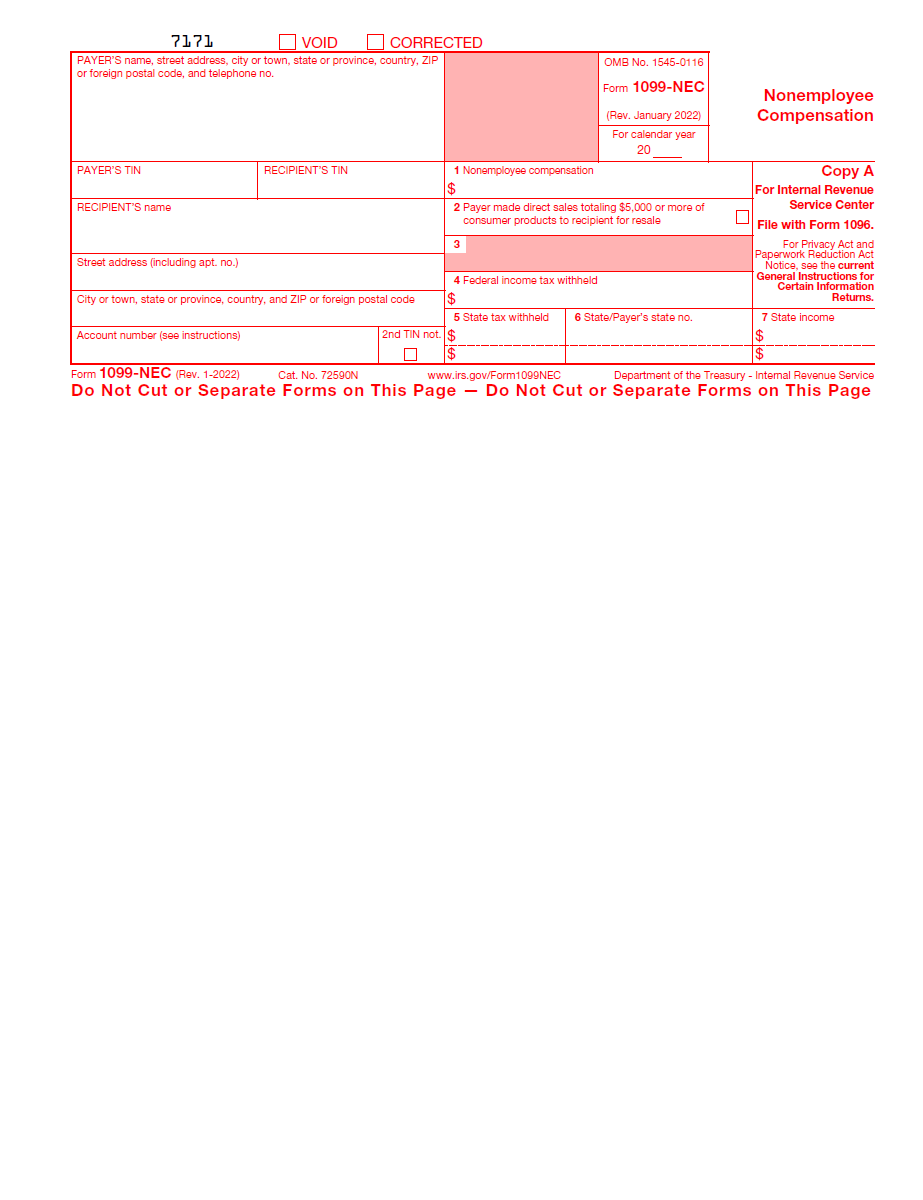

The 1099-NEC is a tax form used to report non-employee compensation, such as freelance or contract work.

It was introduced in 2020 to replace the 1099-MISC box 7, which was previously used to report non-employee compensation. Businesses are required to issue a 1099-NEC to any individual or unincorporated business they paid at least $600 in non-employee compensation in a tax year. The recipient of the 1099-NEC must report this income on their tax return, even if they do not receive a physical copy of the form.

It is important to note that the 1099-NEC is only used for reporting non-employee compensation, and other types of income reported on the 1099-MISC, such as rent or prize money, should continue to be reported on that form.

The 1099-MISC is a tax form used to report income received by a person or business that is not an employee salary or wages. It is typically used to report income from freelance or contract work, rent, or other types of miscellaneous income.

Businesses are required to issue a 1099-MISC to any individual or unincorporated business they paid at least $600 in rent, services (including parts and materials), prizes and awards, or other income payments in a tax year.

The recipient of the 1099-MISC must report this income on their tax return, even if they do not receive a physical copy of the form.

The 1099-DIV is a tax form used to report dividend and distribution income received by an individual or business during the tax year. This includes dividends paid by a company's stock, as well as distributions from a partnership, estate, trust, or mutual fund.

Businesses and financial institutions are required to issue a 1099-DIV to any individual or business that received at least $10 in dividend or distribution income during the tax year. The recipient of the 1099-DIV must report this income on their tax return, even if they do not receive a physical copy of the form.

It is important to note that the 1099-DIV is only used for reporting dividend and distribution income, and other types of income should be reported on the appropriate form.

The 1099-INT is a tax form used to report interest income received by an individual or business during the tax year. This includes interest earned from bank accounts, certificates of deposit, and corporate bonds, as well as any interest income from a mortgage or other loan.

Businesses and financial institutions are required to issue a 1099-INT to any individual or business that received at least $10 in interest income during the tax year. The recipient of the 1099-INT must report this income on their tax return, even if they do not receive a physical copy of the form.

It is important to note that the 1099-INT is only used for reporting interest income, and other types of income should be reported on the appropriate form.

The W-2 is a tax form used to report wages, salaries, and other compensation earned by an employee during the tax year. It is issued by an employer to an employee, and it includes information such as the employee's total earnings for the year, the amount of federal, state, and other taxes withheld from their pay, and the employee's Social Security and Medicare contributions.

The W-2 also includes the employer's name, address, and tax identification number. Employees are required to report their W-2 income on their tax return and must provide a copy of the form to the IRS.

It is important to note that the W-2 is only used for reporting wages and other employee compensation, and other types of income should be reported on the appropriate form.

The following forms are issued by their respective agencies.

The 1099-B is a tax form used to report the sale or exchange of securities, such as stocks, bonds, and mutual funds. It is issued by a brokerage firm or other financial institution to an individual or business that sold securities during the tax year.

The 1099-B includes information such as the date of the sale, the type and number of securities sold, and the proceeds from the sale. The recipient of the 1099-B must report this information on their tax return, even if they do not receive a physical copy of the form.

It is important to note that the 1099-B is only used for reporting the sale of securities, and other types of income should be reported on the appropriate form.

The 1099-C is a tax form used to report cancellation of debt, such as when a lender forgives or cancels a loan or when a credit card company writes off a debt as uncollectible. It is issued by the lender or creditor to the borrower or debtor.

The 1099-C includes information such as the amount of debt cancelled and the date of the cancellation. The recipient of the 1099-C may be required to report the cancelled debt as taxable income on their tax return, even if they do not receive a physical copy of the form.

It is important to note that there are certain exceptions and exclusions that may allow the borrower to exclude the cancelled debt from their income, such as in the case of bankruptcy or insolvency.

The 1099-R is a tax form used to report distributions from a retirement account, such as a traditional individual retirement account (IRA), 401(k), or pension plan. It is issued by the financial institution or employer that manages the retirement account to the account holder.

The 1099-R includes information such as the amount of the distribution, any federal income tax withheld from the distribution, and the type of distribution, such as a rollover or early withdrawal. The recipient of the 1099-R must report the distribution on their tax return, even if they do not receive a physical copy of the form.

It is importa nt to note that the 1099-R is only used for reporting distributions from retirement accounts, and other types of income should be reported on the appropriate form.

The 1099-S is a tax form used to report the sale or transfer of real estate. It is issued by a title company, real estate agent, or other individual or business involved in the sale or transfer to the seller or transferor.

The 1099-S includes information such as the sale price, any mortgage or loan information, and any real estate commissions or fees paid. The recipient of the 1099-S may be required to report the sale or transfer on their tax return, even if they do not receive a physical copy of the form.

It is important to note that the 1099-S is only used for reporting the sale or transfer of real estate, and other types of income should be reported on the appropriate form.

The 1099-T is a tax form used to report tuition payments and related expenses received by a student or educational institution. It is issued by the educational institution to the student or to the person or entity that paid the tuition on behalf of the student.

The 1099-T includes information such as the amount of tuition paid, any scholarships or grants received, and any other education-related expenses paid. The recipient of the 1099-T may be able to claim education-related tax credits or deductions on their tax return based on the information reported on the form.

It is important to note that the 1099-T is only used for reporting tuition payments and related expenses, and other types of income should be reported on the appropriate form.

The 1098 is a tax form used to report mortgage interest paid by a borrower during the tax year. It is issued by a lender to a borrower who has paid at least $600 in mortgage interest during the tax year.

The 1098 includes information such as the amount of mortgage interest paid, any points paid to obtain the mortgage, and the mortgage account number. The borrower may be able to claim a tax deduction for the mortgage interest paid, and the information on the 1098 is used to claim the deduction.

It is important to note that the 1098 is only used for reporting mortgage interest paid, and other types of expenses should be reported on the appropriate form.

The 1098-T is a tax form used to report tuition and fees paid to a higher education institution, such as a college or university. It is issued by the institution to the student, and it includes information such as the amount of tuition and fees paid, any scholarships or grants received, and any amounts billed but not paid.

The recipient of the 1098-T may be able to claim education tax credits or deductions on their tax return, such as the American Opportunity Tax Credit or the Lifetime Learning Credit.

It is important to note that the 1098-T is only used for reporting tuition and fees paid to a higher education institution, and other types of income or expenses should be reported on the appropriate form.

The 1095-B is a tax form used to report information about an individual's health insurance coverage. It is issued by the insurance company or employer that provides the coverage to the insured individual.

The 1095-B includes information such as the individual's name and policy number, the months that the individual had coverage, and the names of any dependents covered under the policy. The recipient of the 1095-B does not need to submit a copy of the form to the IRS, but they should keep it for their records and may need to refer to it when completing their tax return.

It is important to note that the 1095-B is only used to report information about health insurance coverage, and other types of income should be reported on the appropriate form.

The 1095-C is a tax form used to report information about an individual's enrollment in a qualified health plan offered by an employer. It is issued by the employer to the employee, and it includes information such as the months that the employee was enrolled in coverage and whether the coverage was considered "affordable" and met the minimum value requirements under the Affordable Care Act. The employee does not need to attach the 1095-C to their tax return, but they should keep it for their records.

It is important to note that the 1095-C is only used for reporting information about health insurance coverage offered by an employer, and individuals who obtained coverage through the Health Insurance Marketplace or other sources should use a different form, such as the 1095-A.

The 1094-C is a tax form used by large employers to report the information required under the Affordable Care Act (ACA) to the Internal Revenue Service (IRS). Specifically, the form is used to report whether the employer offered its full-time employees and their dependents the opportunity to enroll in minimum essential coverage under an eligible employer-sponsored plan.

The form is also used to report certain information about the coverage offered, including the cost and the portion of the cost paid by the employee. In addition to the 1094-C, large employers are also required to provide their full-time employees with a Form 1095-C, which provides more detailed information about the coverage offered and whether the employee was enrolled in the coverage.

The 1042-S is a tax form used to report certain types of income received by a foreign person or business, such as income from a U.S. trade or business or income that is effectively connected with a U.S. trade or business. It is issued by the payer of the income, such as an employer or financial institution, to the recipient of the income.

The 1042-S includes information such as the amount of income received, any taxes withheld from the income, and the type of income, such as wages or dividends. The recipient of the 1042-S must report the income on their tax return, even if they do not receive a physical copy of the form.

It is important to note that the 1042-S is only used for reporting certain types of income received by foreign persons or businesses, and other types of income should be reported on the appropriate form.

"I may not be a tax expert, but I know that tax forms are about as fun as a root canal - and just about as painful, too!"