Additional Forms

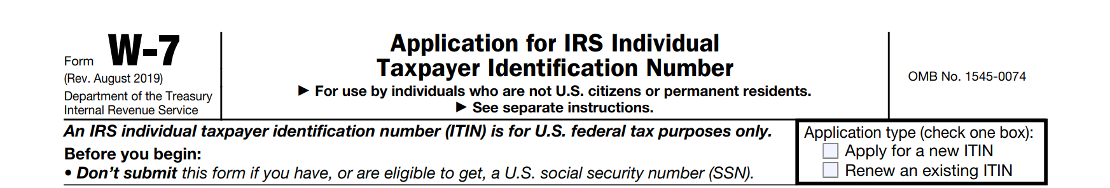

Form W-7 (ITIN)

If you don’t have a Social Security Number and don’t qualify to get one,

you may be required to apply for an Individual Taxpayer Identification Number (ITIN) on Form W-7.

This is NOT a standalone product.

A tax return must be attached to the W-7 Application. If you need help with tax return preparation, choose from the individual tax return packages with W-7 service included. If we're not preparing your tax return, you will be required to bring your Original or Amended Tax Return ‘signed and dated.’ We will mail your W-7 Application with your tax return directly to the IRS ITIN Unit.

DIY - File your own Form W-7!

Are you filing your own return and want to complete your W-7 application too?

You will need to complete Form W-7 and mail it with your original documents to the IRS ITIN Unit.

Here is the form and instructions.

• Form W-7 (Rev. August 2019) (irs.gov)

• Instructions for Form W-7 (11/2021) | Internal Revenue Service (irs.gov)

We recommend you follow the instructions carefully to avoid delays or loss of documents.

Let Paz Tax handle it!

As a Certifying Acceptance Agent (CAA) we are an authorized agent by the IRS to assist individuals who are residing in or outside of the United States, and who are in process of obtaining an ITIN (Tax ID) from the IRS by validating the person’s foreign status and identity.

-

By working with a CAA, you will not be required to send original personal document information to the IRS, such as IDs, passports, and birth certificates.

-

By working with us, we ensure your application is free of errors and proper documentation is submitted to avoid delays. We will also work with you until your application is processed, should the IRS request additional information. No additional fees will be charged provided a response and information is submitted by the notice due date.

Service and Appointment

Is this the service you need? If so, add this service to your cart and process the payment to schedule an appointment at available dates and times. Your appointment will be confirmed after the payment is processed and you will receive an email confirmation. Please bring to your appointment all the items that apply to you from the tax preparation checklist.