Individual - SchC (Single Member LLC)

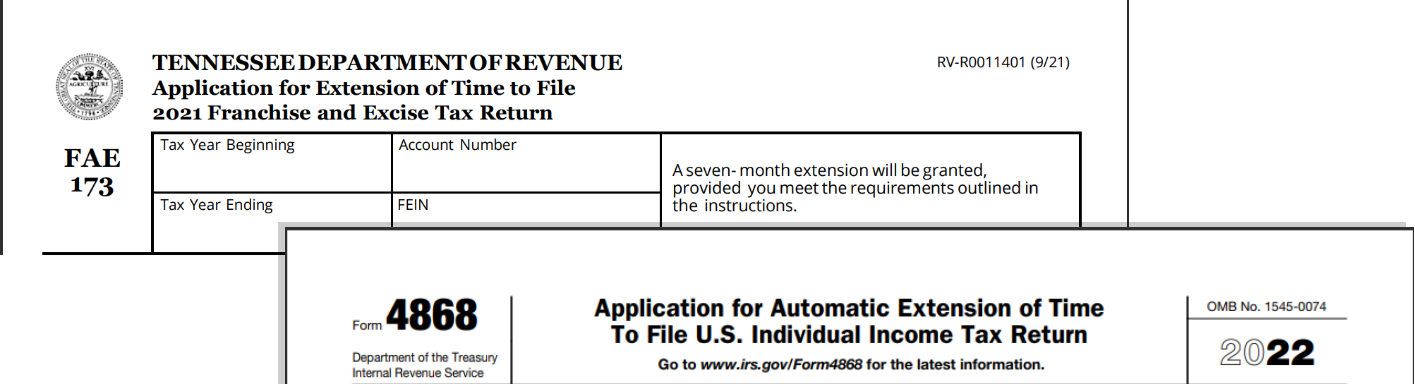

Federal & State Tax Return Extension

See Federal Tax Return on Part 1 and Tennessee State Tax Return on Part 2

Do you need more time to file? Are you still gathering documents or waiting for tax information?

If you need more time, you should file a tax extension which will grant you an additional 6-months to file.

Part 1 - Individual Federal Tax Return Extension

Keep in mind… an extension is an extension to file, not to pay. You must pay your tax in full by the tax deadline. If you’re not sure of how much you will owe, you should pay 100% of prior year taxes to avoid a late payment penalty.

The Tax Deadline for Individual Federal Tax Return is: April 15

Here are a few things you should know about a federal tax extension:

-

A federal tax extension is an extension to file, not to pay.

-

You are required to pay your tax balance by the tax deadline.

-

You can still file an extension even if you don’t pay your taxes.

-

If you don’t pay your full balance by the tax deadline, the IRS may assess a Late Payment penalty and interests.

-

You should e-file your extension before the tax deadline.

-

If you will be mailing your extension request, complete Form 4868 and send Certified Mail by the tax deadline. About Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return | Internal Revenue Service (irs.gov)

DIY - Use Free File

Individual tax filers, regardless of income, can use IRS Free File to electronically request an automatic tax-filing extension.

Follow these IRS instructions and Do-It-Yourself:

Extension of Time To File Your Tax Return | Internal Revenue Service (irs.gov)

Part 2 - Tennessee State Tax Return Extension

Keep in mind…

an extension is an extension to file, not to pay.

You must pay your tax in full by the tax deadline. If you’re not sure of how much you will owe, you should pay 100% of prior year taxes to avoid a late payment penalty.

The Tax Deadline for Tennessee State Tax Return is: April 15

Tennessee state requires the Franchise & Excise Tax be paid based on the prior years liability. If you are not able to pay your tax liability to the state in full, the state requires a minimum fee of $100 to file your extension. Additionally, the Department of Revenue may assess penalty and interest if the tax owed is not paid in full by the tax deadline.

In order to assist you with the Franchise & Excise tax extension request the state requires 100% of last year's tax liability be paid or a minimum $ 100 tax payment must be submitted with your extension. This amount or other payment amount you choose to pay with the extension will be applied towards the final tax owed when you file your business state tax return.

You will be required to provide banking information in order to complete this request.

DIY – File the state tax extension on your own using TNTAP!

Tennessee businesses can file a Franchise & Excise tax extension for free using Tennessee Taxpayer Access Point (TNTAP). Businesses can create an account to login and file the state tax extension, and file and pay state and local taxes.

Login: TNTAP

For help on creating an account, click on Information and Inquiries, for How-to-Videos.

Need help filing an extension?

If you're a returning client, we will file both your Federal and Tennessee State Tax extension at no charge for your Single-Member LLC provided you submit your request in time. In order to submit your request, complete the attached form and upload it to your portal 15 days before the tax deadline to avoid a late fee. Follow the instructions below and Let Paz Tax handle it!

All new clients or requests submitted within 15 days of the tax deadline will be charged a $150 fee in addition to tax preparation fees. This fee must be paid with the request. A discount of $50 is applied for filing both extensions together .

Part 3 - Let Paz Tax handle it!

Add this service to your cart and process your payment. You will receive an email with a link to complete a form with your information to file the extension. A tax payment will be scheduled only if you authorize payment and provide banking information; otherwise, your extension will be filed with no payment.

you and your spouse BOTH need to sign and date.

Not sure what you need?

Schedule a call back with one of our Service Specialists. You will receive:

-

Complimentary call back to guide you through our services

-

Take payment for your request

-

Confirm your email for the links.